A term deposit usually pays a higher rate of interest than a regular savings account, with the interest rate fixed for the term (or duration) of the deposit. You can open a term deposit account for one month or up to five years depending on your investment goal, and invest as little as $500 to start earning a profit.

Your clients will be able to view their statements online once issued. This depends on the statement cycles which differs based on the product.

Cash Management Accounts

By default, your clients will receive their cash statements in half-yearly cycles. They can change this though if they want statements more frequently. The options for statement deliveries are:

- Half Yearly: January-June; July-December

- Quarterly: January-March; April-June; July-September; October-December

- Monthly.

Macquarie Bank Term Deposit Rates Australia

Statements are available online the day after the last day in the statement cycle. This includes weekends. Statements are also available online for up to ten years. Your client can elect to receive hard copies of their statements via the post. Please note that fees may apply for hard copy statements.

For more details see Macquarie.com.au/investing/cash-management-account

For more information about statements, see Do clients receive tax statements and statements via mail?

Cash Management Accelerator Accounts

Your clients will receive their Accelerator statements in half-yearly cycles by default. They can change this if they want to receive statements quarterly or monthly instead.

Term Deposits

Your clients will receive their half yearly term deposit statements by mail. These are sent out every 6 months at the end of June and December.

IDPS Accounts

Your clients can access their annual and quarterly statements for their Wrap Investment accounts online.

Quarterly statements are available online by the end of the month following the financial quarter. Instant checking account no deposit. That is the end of January, April, and October each year. Annual statements are available before the end of July.

Superannuation and Pension Accounts

Your clients can access their half yearly report and annual statement for their super and pension accounts online.

As an adviser you can view and download your client's statements through Adviser Online. However, you won't be able to change their statement preferences.

Macquarie Bank Term Deposit Rates

Your clients will be able to view their statements online once issued. This depends on the statement cycles which differs based on the product.

Cash Management Accounts

By default, your clients will receive their cash statements in half-yearly cycles. They can change this though if they want statements more frequently. The options for statement deliveries are:

- Half Yearly: January-June; July-December

- Quarterly: January-March; April-June; July-September; October-December

- Monthly.

Macquarie Bank Term Deposit Rates Australia

Statements are available online the day after the last day in the statement cycle. This includes weekends. Statements are also available online for up to ten years. Your client can elect to receive hard copies of their statements via the post. Please note that fees may apply for hard copy statements.

For more details see Macquarie.com.au/investing/cash-management-account

For more information about statements, see Do clients receive tax statements and statements via mail?

Cash Management Accelerator Accounts

Your clients will receive their Accelerator statements in half-yearly cycles by default. They can change this if they want to receive statements quarterly or monthly instead.

Term Deposits

Your clients will receive their half yearly term deposit statements by mail. These are sent out every 6 months at the end of June and December.

IDPS Accounts

Your clients can access their annual and quarterly statements for their Wrap Investment accounts online.

Quarterly statements are available online by the end of the month following the financial quarter. Instant checking account no deposit. That is the end of January, April, and October each year. Annual statements are available before the end of July.

Superannuation and Pension Accounts

Your clients can access their half yearly report and annual statement for their super and pension accounts online.

As an adviser you can view and download your client's statements through Adviser Online. However, you won't be able to change their statement preferences.

Macquarie Bank Term Deposit Rates

Macquarie Bank Term Deposit Rates Singapore

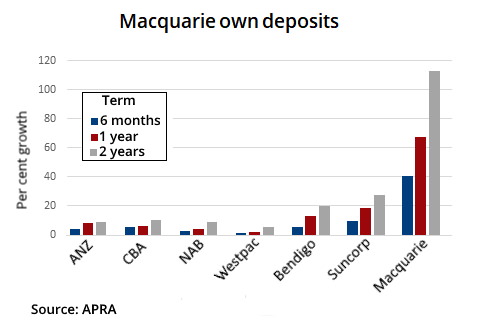

Withdrawal of funds from your Term Deposit Account before its designated maturity date will be at Macquarie's discretion and a break fee may be charged to you. The break fee for breaking a Term Deposit. Macquarie Bank 6 Month Term Deposit Rate indicated is for deposits between $10,000 to $1 million. The rate of 1.65% is 0.07% lower than the average 1.72%. Icici fixed deposit. Also it is 0.85% lower than the highest rate 2.50. Of course, each term comes with its own interest rate, with the highest currently on offer being 0.60% for a 1 year term. Just keep in mind that a minimum deposit of $5,000 and a maximum deposit of $1,000,000 applies to all Macquarie Term Deposits. The Macquarie Term Deposit.